Imagine having financial software tailored specifically to your needs. It sounds like a dream, right?

Custom financial software development is not just about creating software; it’s about crafting solutions that fit perfectly into your business puzzle. Whether you’re a small business owner or part of a large corporation, you know that every financial decision counts.

What if you had the power to streamline those decisions with software designed just for you? You’ll discover how custom financial software development can transform the way you manage money, optimize processes, and enhance your overall financial strategy. Dive in and see how personalized technology can become your strongest ally in achieving financial success. Get ready to explore the potential of a bespoke software solution that understands your unique challenges and goals.

Credit: shakuro.com

Benefits Of Custom Financial Software

Custom financial software development offers many advantages for businesses. It tailors solutions to unique needs and enhances security. It improves efficiency and supports growth. Understanding these benefits can guide better financial decisions.

Tailored Solutions For Unique Needs

Every business has different needs. Off-the-shelf software often misses specific requirements. Custom software caters to individual business processes. This ensures a perfect fit. It aligns with your goals and strategies. This personal touch enhances performance.

Enhanced Data Security

Data breaches are a growing threat. Custom software offers strong protection. It includes advanced security features. These meet industry standards and protect sensitive information. This reduces risks and builds customer trust. Businesses can operate with peace of mind.

Improved Operational Efficiency

Custom software streamlines operations. It automates manual tasks and reduces errors. Employees can focus on core tasks. This boosts productivity and lowers costs. Efficient systems lead to better decision-making.

Scalability And Flexibility

Businesses evolve over time. Custom software adapts to changing needs. It grows with your business. This flexibility allows for easy updates and expansions. It ensures long-term value and supports future growth.

Key Features Of Custom Financial Software

Custom financial software is transforming how businesses manage their financial processes. With unique features tailored to specific needs, this software is becoming an essential tool for improving efficiency and accuracy. Let’s dive into some key features that make custom financial software development a game-changer for businesses.

Automated Reporting And Analytics

Imagine having reports generated without lifting a finger. Automated reporting saves time and reduces errors, allowing you to focus on decision-making. Advanced analytics offer insights into financial trends, helping you anticipate market changes and adapt strategies.

Consider a small business owner who struggled with manual reports. After adopting automated reporting, they found more time to strategize and saw a 15% increase in profitability. What would you do with extra hours each week?

Integration With Existing Systems

Custom software should blend seamlessly with your current systems. This integration eliminates the headache of switching between multiple platforms, ensuring smooth data flow. Having everything in one place enhances productivity and minimizes the risk of data loss.

Think about how much easier life could be if your accounting software talked to your CRM. Integration streamlines operations, letting your team focus on their core tasks instead of wrestling with technology.

User-friendly Interfaces

A user-friendly interface is not just a luxury; it’s a necessity. If your team can’t navigate the software easily, it becomes more of a hindrance than a help. Custom financial software prioritizes intuitive design to boost adoption and efficiency.

Remember the frustration of using clunky software that felt like it was from another era? Modern interfaces ensure your team can quickly find what they need, reducing training time and increasing satisfaction.

Real-time Data Access

Real-time data access keeps you in the know at all times. With instant updates, you can make informed decisions swiftly, maintaining a competitive edge. This feature is crucial in industries where market conditions change rapidly.

Imagine needing to make a critical financial decision and having outdated data. Real-time access ensures that you always work with the most current information, enhancing your confidence and accuracy.

Custom financial software development offers practical, tailored solutions that address your unique business needs. Which feature would make the biggest difference in your operations? Perhaps it’s time to explore what custom solutions can do for you.

Steps In Developing Custom Financial Software

Developing custom financial software involves analyzing client needs, designing tailored solutions, and implementing secure systems. Testing ensures reliability, while integrating with existing platforms enhances functionality. Ongoing support and updates maintain software efficiency and compliance with financial regulations.

Custom financial software development involves several key steps. Each stage requires careful planning and execution. Understanding these steps can help streamline the development process. Let’s delve into the essential phases involved in creating custom financial software.

Requirement Gathering And Analysis

The journey begins with gathering requirements. Developers meet with stakeholders to understand their needs. This involves identifying business objectives and user expectations. Analyzing these requirements ensures the software aligns with business goals. Clarity in this phase prevents future misunderstandings.

Design And Prototyping

Next, the design phase transforms ideas into visual models. Designers create wireframes and prototypes to illustrate software structure. These prototypes serve as a blueprint for developers. Feedback is gathered to refine the design before actual development. This step helps visualize the end product.

Development And Testing

In this phase, developers start coding the software. They follow the design blueprint to build functional features. Testing is crucial to identify and fix bugs. Developers conduct unit tests to ensure each component works well. This step guarantees a robust and reliable software product.

Deployment And Maintenance

Finally, the software is deployed for users. Deployment involves installing the software on user systems. After deployment, maintenance becomes vital. Regular updates and support ensure the software remains efficient. This phase includes troubleshooting and enhancing features. Keeping the software up-to-date is essential for security and functionality.

Credit: rndpoint.com

Choosing The Right Development Partner

Choosing the right development partner for custom financial software is crucial to your project’s success. The right partner not only brings technical skills but also understands your industry’s unique challenges and opportunities. It’s like finding a trusted advisor who can translate your vision into reality. But how do you ensure you’re making the right choice? Let’s break it down.

Evaluating Technical Expertise

Technical expertise is the backbone of your software project. You want a team that can handle complex algorithms, ensure data security, and build user-friendly interfaces. But technical jargon can be overwhelming. Ask potential partners to explain their processes in simple terms. This will reveal their ability to communicate clearly—a vital skill in any collaboration. How confident are they in their ability to meet your technical needs?

Assessing Industry Experience

Industry experience often determines how well a partner can anticipate challenges before they arise. If you’re in finance, look for developers familiar with regulations and compliance issues. This experience translates into smoother project execution. Have they worked with similar businesses? Their past industry knowledge can save you time and resources.

Understanding Client Collaboration

Effective collaboration ensures your vision stays intact throughout development. A good partner will not only listen but also contribute valuable insights. Communication should be a two-way street. Are they open to feedback? Test their responsiveness by discussing your initial ideas. You want someone who respects your input while offering constructive advice.

Reviewing Past Projects

Past projects are a window into a partner’s capabilities. Examine their portfolio for diversity and innovation. Do their projects reflect creativity and problem-solving skills? You can learn a lot from their case studies. Consider asking for references. Real-world testimonials can provide honest insights into their work ethic and reliability.

Choosing the right partner is a strategic decision that can make or break your project. With the right questions and assessments, you can find someone who aligns with your goals and values. What qualities matter most to you in a development partner? Your answers will guide you to the perfect match.

Cost Considerations

Custom financial software development offers tailored solutions for unique business needs. Understanding cost considerations is crucial for budget planning. Development costs can vary widely based on several factors. It’s important to consider future upgrades and perform a cost-benefit analysis to ensure a wise investment.

Factors Affecting Development Costs

Several elements influence the cost of developing financial software. The complexity of features plays a significant role. More features mean higher costs. The choice of technology stack impacts expenses too. Opting for advanced technologies can increase costs. The experience level of the development team is another factor. Experienced developers might charge more but offer quality assurance. Project timeline can also affect costs. A shorter timeline often requires more resources, raising expenses.

Budgeting For Future Upgrades

Technology evolves rapidly. Planning for future upgrades is essential. Allocating a budget for updates ensures your software remains relevant. Regular upgrades improve functionality and security. Consider the costs of integrating new features. Budgeting for these changes helps avoid unexpected expenses. A proactive approach to upgrades can save money in the long run.

Cost-benefit Analysis

Performing a cost-benefit analysis is vital. It helps determine if the investment in software is worthwhile. Evaluate the potential benefits of custom software. Increased efficiency and streamlined processes can lead to savings. Compare these benefits against development and upgrade costs. A clear analysis guides decision-making. It ensures the investment aligns with business goals.

Future Trends In Financial Software Development

The world of finance is evolving rapidly, and custom financial software development is at the forefront of this transformation. As businesses strive to keep up with changing demands, understanding future trends in financial software development becomes crucial. You might be wondering, what technologies will shape the future of financial software? Let’s dive into some key trends that are likely to make waves.

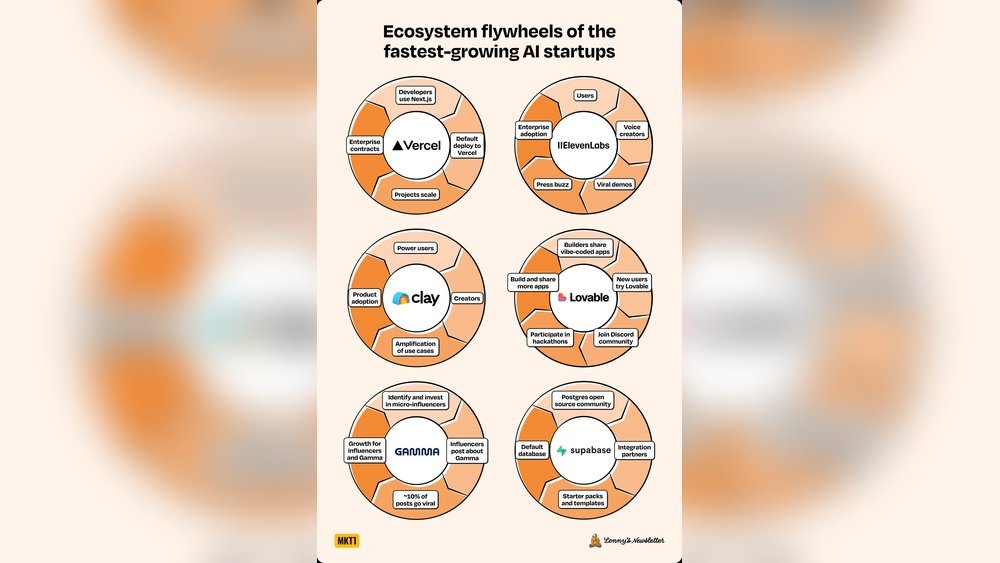

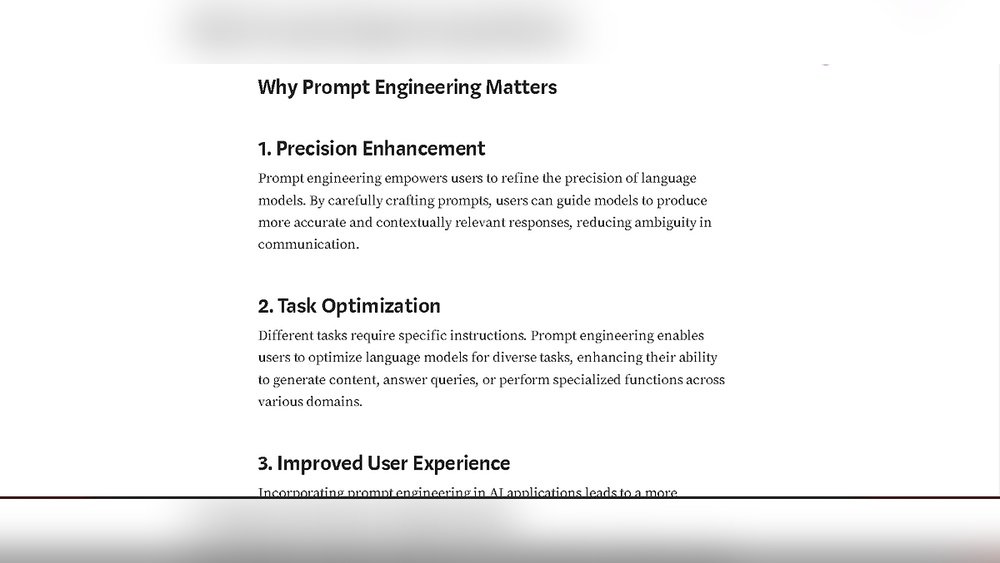

Incorporating Artificial Intelligence

Artificial Intelligence is not just a buzzword; it’s a game-changer in financial software development. Picture AI as a smart assistant that can analyze vast amounts of data quickly and accurately. It helps you make informed decisions by identifying patterns and predicting future trends. You can imagine how this could save time and reduce errors in financial forecasts. Have you considered how AI could streamline your operations?

Emphasizing Blockchain Technology

Blockchain is no longer just about cryptocurrencies. It’s emerging as a powerful tool in financial software, offering transparency and security. Imagine a system where transactions are recorded in a decentralized ledger, reducing fraud and increasing trust. Blockchain can transform how you handle contracts and transactions. Are you ready to explore how blockchain could protect your financial data?

Focusing On Cybersecurity Enhancements

In today’s digital age, cybersecurity is more important than ever. Financial data is sensitive, and breaches can be costly. Think of cybersecurity as the shield that guards your information from threats. Enhancements in this area ensure that your financial software is robust and resilient. Have you evaluated how secure your current system is? Upgrading security measures can prevent potential risks and safeguard your assets.

The landscape of financial software is evolving, and staying ahead means embracing these trends. Are you prepared to adapt and innovate?

Credit: appinventiv.com

Frequently Asked Questions

What Is Custom Financial Software Development?

Custom financial software development involves creating tailored software solutions for financial institutions. These solutions address specific business needs, enhancing efficiency and security. It includes features like data analysis, transaction management, and compliance tracking. Custom solutions provide a competitive edge, aligning closely with organizational goals and regulatory requirements.

Why Choose Custom Financial Software Over Off-the-shelf?

Custom financial software offers personalized features that meet specific business needs. Unlike off-the-shelf solutions, it can be tailored to integrate seamlessly with existing systems. This flexibility ensures better data management, improved security, and scalability. Custom software adapts to changing regulations, ensuring compliance and reducing operational risks.

How Does Custom Software Improve Financial Security?

Custom software enhances financial security by implementing advanced encryption and authentication measures. It offers tailored security protocols that address specific threats. Regular updates ensure protection against emerging vulnerabilities. Custom solutions also facilitate compliance with industry standards, safeguarding sensitive financial data from unauthorized access and cyber threats.

What Are The Costs Involved In Custom Development?

The costs of custom financial software development vary based on complexity and features. Initial investment may be higher than off-the-shelf solutions but offers long-term savings. Factors influencing costs include development time, technology stack, and ongoing maintenance. However, the tailored benefits and improved efficiency often justify the expenses.

Conclusion

Custom financial software offers tailored solutions for unique business needs. It enhances efficiency and supports growth. Embrace technology to streamline operations. Personalized features improve user experience and decision-making. Security measures protect sensitive data, ensuring trust. Scalability allows software to grow with your business.

Investing in custom solutions can save time and money. Choose software that matches your goals and challenges. Collaborate with experts for effective design and implementation. Enjoy a system designed specifically for you. Custom financial software is a smart choice. Optimize processes and boost productivity.

Make informed decisions with confidence.

One response to “Custom Financial Software Development: Unlock Business Growth”

[…] July 3, 2025 […]